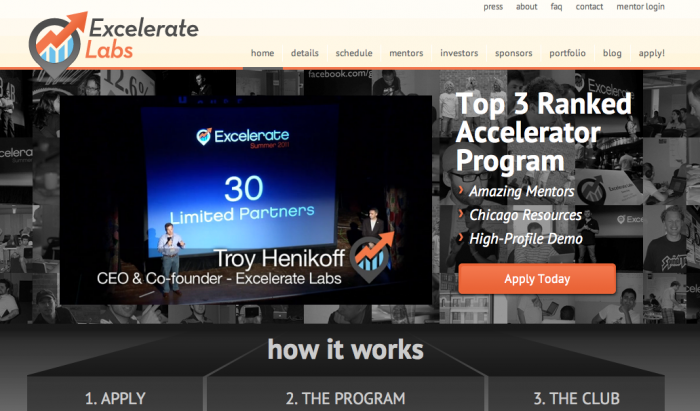

Troy Henikoff, CEO and co-founder of Excelerate Labs—which is described as an intensive summer accelerator for startups—gushes about Chicago’s burgeoning tech startup culture like a professional baseball player coaching a little league team.

“We’ve all learned that if we work together we have a lot more impact and that the rising tide will lift all of us,” Henikoff says, barrowing from a famous Kennedy aphorism.

Henikoff, who founded successful companies like Specialized Systems and Software, and SurePayroll, started Excelerate Labs with OKCupid and SparkNotes founder Sam Yagan, the I2A Fund and Sandbox Industries. The goal being to serve as an entrepreneurial bootcamp, mentoring 10 selected startups leading up to Demo Day, when they present their polished ideas to hundreds of eager investors.

While currently accepting applications for its 2012 summer program, Excelerate Labs will host an Applicant Open House on February 29, with another open house being scheduled for the following week. Henikoff says the open house will give people an opportunity to ask questions, come hang out at Excelerate Labs and meet some of the alums.

Doejo spoke with Henikoff about how Excelerate Labs earned its prominent ranking in Forbes’ top accelerators in the country, why so many entrepreneurs in Chicago want to give back to budding startups, and what he looks for in applicants.

What’s it been like to see so many startups enter and grow at Excelerate Labs?

It’s amazing to see the transformation these companies make over the course of the program. Many of the companies come in thinking they got their business models right, they just need funding. They quickly realize that, ‘wow, this is a lot harder than I thought and there’s a lot more to owning a business then having cash in the bank.’ They really have to test their hypotheses, get feedback from the marketplace and sometimes totally pivot the core of their business model, dramatically.

BabbaCo came in with a business model that was all about providing educational videos for moms and left with a physical tangible product that gets mailed every month, the BabbaBox. Huge pivots in some cases, it’s really cool to see that and help facilitate that process.

How does Forbes quantify your success when they rate you the #3 accelerator in the country?

I don’t know how their rankings work. But the year before there was a similar ranking done by the Kauffman Foundation where we rated #3 as well. They said it was a combination of objective measures: number of companies that got funded over a certain amount, number of companies’ total funding dollars; and subjective measures: from a poll of venture capitalists in terms of which one’s they thought had the most value, and they put it together to come up with the ranking.

Is there anything for the forthcoming class of 2012’s program that you’ll adjust?

We’ve matured. And we’ve learned along the way. We were very much a startup, testing various things, whether it’s how we select companies, how we run the mentoring; last year we experimented bringing IDEO in to do some design work with companies and they had office hours every week, that was great, our companies benefited a ton from that and so did IDEO. We are working on how to take that experience and make it even better. We’re going to change the way mentors work a little bit, more incremental changes.

You have many partnerships with companies like New World Ventures, Sandbox Industries, IDEO, and a variety of other influencers in the tech startup ecosystem. Why is this community so vital for growth?

You can be successful without it, it’s just harder. When I started my first business operating out of my parent’s basement writing software, I had no mentors, I had no one to turn to, I didn’t have a clue. I had to learn it all and make lots of mistakes. We sold that business after 6 years to Medline Industries and I stayed on to run their software division for the next 5 years. After 11 years, I finally felt like I had a handle on this art we call “business.”

So, part of what we do through Excelerate and through the mentorships and formal programming is accelerate that learning progress and accelerate the learning process. During the course of July, our companies are exposed to what I call the ‘Entrepreneurs MBA,’ so everyday from noon to 1:30, there’s a different seminar put on by an expert on topics you need to learn about to run a business. If you are a first time entrepreneur, there is a lot to learn—anything from SEO, HR, PR, key performance indicators, building a financial model, understanding contracts, legal issues, employee motivation, there’s a laundry list of things, things you haven’t really thought about but you need to be exposed to.

When I first started I didn’t know the difference between a balance sheet and an income statement. I had an engineering degree, I could write software and I could solve people’s business problems, but I didn’t know how to read financial statements.

There are a lot of things you can learn from other people’s mistakes or from other people, I can’t tell you how many times someone has come to me for advice and I’ve said, ‘oh, I’ve seen this movie before, I know how it’s going to end.’ I’ve been there, I’ve lived this. You need to hear from a mentor: ‘now that you’re a real company, there’s things you need to deal with.’ That’s where the mentorship and the community really helps.

How did this community become so vibrant and potent in Chicago?

In terms of the vibrancy in the Chicago community, what happened is a couple of things. There was nothing like this before three years ago and so people were hungry for it. You had successful entrepreneurs who, when you’ve been running your business for 10 years, it’s kind of fun to roll up your sleeves with the guy operating in his garage and remember those early days—and to help them, and feel like you’re giving back.

We have a lot of people in Chicago now that have run successful technology businesses that are ready and want to give back. Last year we had 145 mentors who came in and donated their time. And by mentors I mean the founder of Groupon, the founder of GrubHub, founder of Open Table, founder of Priceline—really great people all with great experience.

Chicago, all of a sudden, has become a place where early stage financing is accessible in a way that it wasn’t before. And I attribute that to that we finally have some successful companies in the technology space.

So Chicago’s already had plenty of capital, so if you look at all the private equity firms here—but most of that was made on old-line businesses or financial services. So when those guys have success, they want to reinvest in similar business, whether it’s manufacturing, distribution… they weren’t investing in technology. Contrast that with Silicon Valley, where you had some early successes, Fairchild, Intel, HP, etc., and people that made money from those companies, the early investors, want to do it again. They wanted to invest in technology business and this spiral started to happen and it’s finally happening in Chicago. It’s evident by all the angel groups looking to invest in technology: Hyde Park Angels, Wildcat Angels, Cornerstone Angels, etc., and all the individuals doing it.

Even the Firestarter Fund, where 42 successful entrepreneurs [Henikoff and Sam Yagan of Excelerate Labs among them] put our own money in and pooled our resources to help the early stage entrepreneurs with not only cash, but with our networks and knowledge. It’s just an indication that the tide is turning. No longer is there a lack of capital and you have to go to Silicon Valley to raise money for a startup. You put all those things together and it’s pretty cool.

You must read hundreds of business proposals all the time, how do you keep from becoming cynical? (Henikoff is also a faculty coach at The University of Chicago’s Booth’s Venture Challenge, if you were already wondering where he finds the time to sleep.)

We receive hundreds of applications, the last few years we received about 300, and this year we’re recruiting harder and harder. And yeah, you get a little cynical, you see a lot of patterns, you tend to see the same plans over and over again, but you pick out the one’s that you think are good plans with great entrepreneurs. I firmly, firmly believe that it’s the execution and the entrepreneur that’s the differentiator, much more important than the idea. So Google was not the first company with an idea for a search engine, Ebay wasn’t the first company with the idea of an auction site, you know? But these guys came on top because of how they executed the best.